Cloud based Forex Data Analysis With QuantConnect

Virtualization is the centerpiece of Cloud infrastructure and the need for efficient ways to analyze big data within multiple verticals without taking on the pains of setting up and tuning the right Cloud infrastructure has increased sharply. Cloud based online tools and libraries have the acute value add of eliminating the need to consume your own resources and use remote Cloud based SaaS running on top of pre-configured VM instances. Open free data libraries and browser integrated tools like programming libraries are helping developers, practitioners and researchers primarily because of the swift turnaround time and reduced cost. Clustered computing environments have ushered major amelioration in Cloud performance as multiple machines packed into clusters can fine tune and enhance the access and processing speeds of the Cloud.

Cost effectiveness has really compelled small and large businesses, organizations and individuals toward Cloud adoption. Remote data analysis tools help save time and cost when processing Big Data . QuantConnect is one such interesting startup which makes it easy for financial data practitioners to analyze big Forex data. QuantConnect has built a Cloud based Forex data analysis library which cuts the need to harness complex and expensive deployments. You can spin up a single node with multiple machines without actually doing the machine configuration yourself. Ramping tests must be performed on the remote Cloud server because of the fact that load testing a cluster for performance and scalability can really drain your memory resources which is a precious commodity in a test environment.

Handling complex data sets like Forex has always been challenging especially in commercial settings where putting up a huge cluster wasn’t always an option. There are multiple remote calls and server resources must be managed in a way to handle several requests from client machines. Cloud based libraries and tools like QuantConnect’s Forex data analysis service offers a way to bridge the gap between Forex markets and data scientists who want to make use of this online or offline data poured into the system. You can literally pour in Gigabytes of tick data from last 5 years and analyze it within 30-60, claims the company. QuantConnect’s clean UI and impressive charting and graph tools help practitioners trickle down big forex tick data and make sense of it.

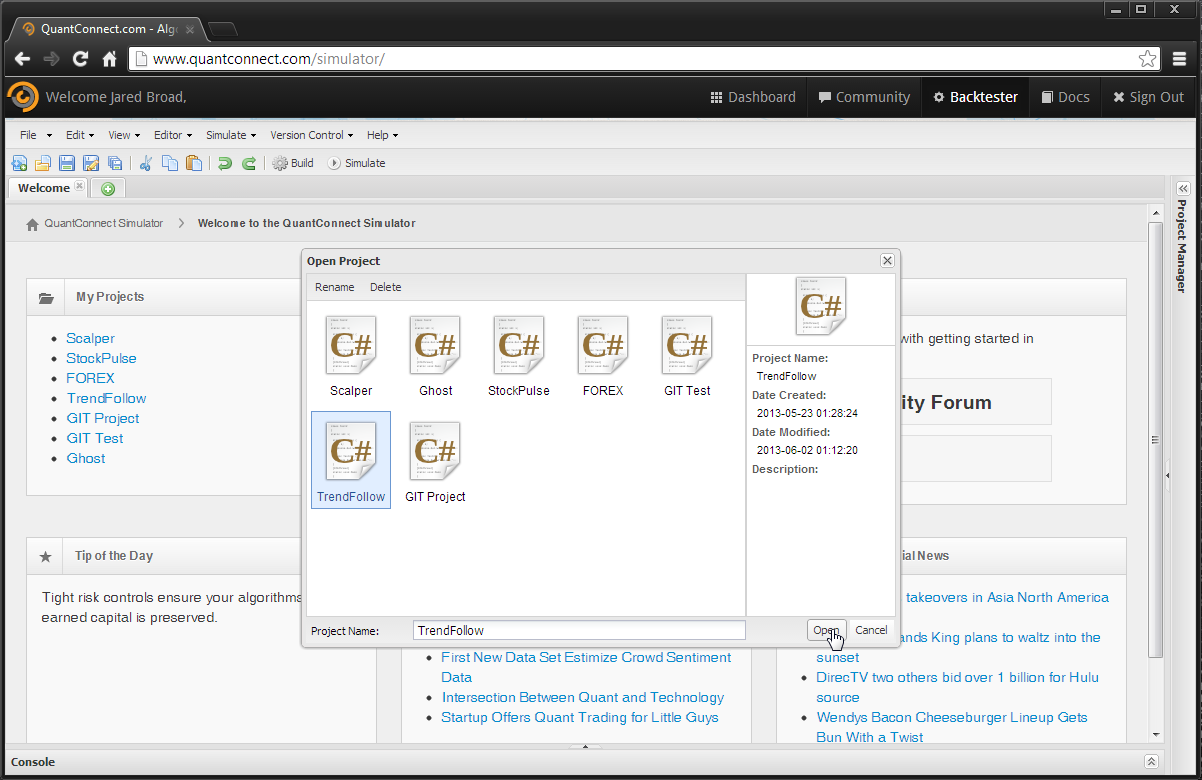

Image: GIT simulation sample

QuantConnect also offers in-browser IDE which lets you load up data, spin a service and deploy your custom data analysis code without leaving your browser. You can use C# to write code snippets and create test projects. There’s an extensive documentation to get developers started with playing big forex data and with gigabytes of it already available for use within their open data library, writing your first “hello world” shouldn’t take more than 10 minutes. You will need to get started with sourcing in data into your custom analysis script – there are multiple data sources you can use. Then once you have the data poured in, you can run queries on it and finally visualize the results using the several UI components available within the library. There are no complex set ups like other Cloud based data analysis services like Amazon’s EMR (Elastic MapReduce) but then it’s a test bed and does not give you much control to configure and fine tune at a lower level. QuantConnect is ideal for quickly analyzing quant data.

By Salman UI Haq

The post Cloud Based Forex Data Analysis With QuantConnect appeared first on CloudTweaks.